Fiduciary Services

What is a fiduciary?

A fiduciary is someone to whom property or power is entrusted for the benefit of another. The fiduciary’s responsibilities largely depend on what the fiduciary has been called upon to do. There are many different types of fiduciaries. The fiduciaries discussed here are those in the estate planning and administration field.

Executor.

A prospective executor is a fiduciary named in a last will and testament. The named executor does not become executor until the person who made the will (the “testator”) has died, and the fiduciary has taken oath before the clerk of court. Appearing before the clerk to take the oath is called “qualification.” After the qualification process, the executor receives a “certificate of qualification.”

In general terms, the executor is responsible for gathering the decedent’s assets, ensuring that the final debts are satisfied, filing the decedent’s final tax returns, and in many instances filing an accounting with the commissioner of accounts. The commissioner of accounts is an attorney appointed by the court who supervises the administration of the estate. The executor is entrusted with the decedent’s assets. The executor must administer those assets for the benefit of the creditors and beneficiaries of the estate, subject to laws governing the administration.

Administrator.

An administrator is similar to an executor, but in instances where someone died without a will. (Such a person is said to have died “intestate.”) An administrator must likewise qualify in the clerk’s office in order to receive a certificate of qualification. As with the executor, an administrator is entrusted with the decedent’s assets and must administer those assets for the benefit of the beneficiaries of the estate.

Trustee.

A trustee is the fiduciary responsible for administering assets in a trust. The trust can be created in a last will and testament (such a trust is called a “testamentary trust”) or created in some other fashion, such as a revocable living trust. (See our Wills & Trusts page for more information.) The trustee has a fiduciary obligation to administer the trust assets according to the terms of the trust.

Attorney-in-fact.

A person who signs power of attorney (the “principal”) appoints an agent, called an attorney-in-fact, who has a fiduciary obligation to act in furtherance of the principal’s best interests. An agent acting under a general durable power of attorney has access to the principal’s assets and is entrusted in using those assets for the principal’s benefit. (A general durable power of attorney is one in which the agent’s authority to act continues despite the principal’s incapacity. The agent’s authority does terminate upon the principal’s death, however.)

Who should I name as my fiduciary?

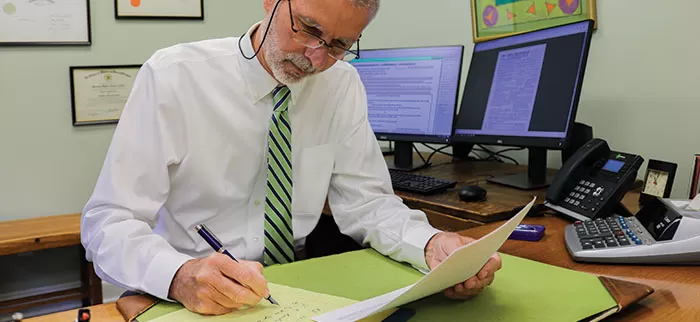

It depends on your circumstances — no one’s are the same. In most instances, the fiduciary is a spouse, a responsible adult child, or a trusted friend or family member. And in most instances, that approach is best. Occasionally, however, there are circumstances when you may want to consider naming a professional fiduciary, such as a law firm or a trust department at a bank. A professional fiduciary is one experienced in administering estates, filing accountings, dealing with tax returns, and so on.

Professional fiduciaries should be considered when an estate is particularly complicated, beneficiaries do not get along, a beneficiary has special needs (such as a disability or a problem managing money), or if there is no one else who can or wants to serve as the fiduciary.